TPaaS Latest 2022

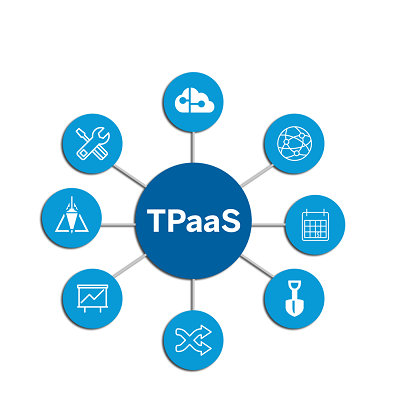

What is TPaaS?

TPaaS (Transaction payments as a service)

It is a phrase used to describe a SaaS-based methodology which allows platforms to become their own merchant platforms and provide merchant services directly. This is distinct from payments as a service which aggregates multiple payment technologies into one platform.

TPaaS -Payments as a service (PaaS) is a marketing phrase used to describe a software as a service to connect a group of international payment systems. The architecture is represented by a layer – or overlay – that resides on top of these disparate systems and provides for two-way communications between the payment system and the PaaS. Communication is governed by standard APIs created by the PaaS provider.

Since the 1980s, credit cards and international wire transfer systems like the Society for Worldwide Interbank Financial Telecommunication (SWIFT) were primary methods for making and receiving electronic cross-border payments.

Within individual countries, payers and payees have used various electronic systems to make such payments. In the United States, for instance, the Federal Reserve Bank operates the automated clearing house (ACH) system.

In the Eurozone the Single Euro Payments Area (SEPA) defines the rules for credit transfer (SCT) and direct debits (SDD) for Euro payments and these are implemented by various clearing and settlement both within Eurozone countries and for pan-European payments.

SEPA Instant (SCT Inst) has been available since November 2017 for single immediate payments. The ECB provides a real time gross settlement system (RTGS) for SEPA payments called TARGET2.The ECB also provides TIPS for immediate settlement of SEPA payments using TARGET2. RT1 from EBA Clearing provides a pan-European ACH (PEACH) for SEPA instant payments settling on TARGET2.

With the advent of the World Wide Web, it became necessary to provide alternative payment systems. At first, consumers were hesitant to use their credit cards on the Web due to security concerns. Entrepreneurs tried to market an “electronic wallet”. As early as 1994, CyberCash allowed consumers to make secure purchases over the Internet.

CyberCash eventually failed. In March 2000, PayPal was formed and became a predominant electronic wallet in the U.S. Similar regional services include WebMoney and Yandex.Money in Russia and Alipay in China.

While popular in their own countries, these do not have significant global reach. PayPal and Moneybookers (Skrill) became regional electronic wallets, providing greater liquidity, but still do not provide for the free flow of funds between all popular electronic wallet solutions.

The TPaaS layer allows organisations to become their own merchant provider, this facilitates functionality that is normally only available to merchant aggregators such as commission splits, merchant of record and instant onboarding.

SaaS

SaaS is considered to be part of cloud computing, along with infrastructure as a service (IaaS), platform as a service (PaaS), desktop as a service (DaaS), managed software as a service (MSaaS), mobile backend as a service (MBaaS), data center as a service (DCaaS), integration platform as a service (iPaaS), and information technology management as a service (ITMaaS).

SaaS apps are typically accessed by users using a thin client, e.g. via a web browser. SaaS became a common delivery model for many business applications, including office software, messaging software, payroll processing software, DBMS software, management software, CAD software, development software, gamification, virtualization, accounting, collaboration, customer relationship management (CRM), management information systems (MIS), enterprise resource planning (ERP), invoicing, field service management, human resource management (HRM), talent acquisition, learning management systems, content management (CM), geographic information systems (GIS), and service desk management.

SaaS has been incorporated into the strategy of nearly all enterprise software companies.

Centralized hosting of business applications dates back to the 1960s. Starting in that decade, IBM and other mainframe computer providers conducted a service bureau business, often referred to as time-sharing or utility computing. Such services included offering computing power and database storage to banks and other large organizations from their worldwide data centers.

The expansion of the Internet during the 1990s brought about a new class of centralized computing, called application service providers (ASP). ASPs provided businesses with the service of hosting and managing specialized business applications, to reduce costs through central administration and the provider’s specialization in a particular business application.

Two of the largest ASPs were USI, which was headquartered in the Washington, DC area, and Futurelink Corporation, headquartered in Irvine, California.

Software as a service essentially extends the idea of the ASP model. The term software as a service (SaaS), however, is commonly used in more specific settings:

While most initial ASPs focused on managing and hosting third-party independent software vendors’ software, as of 2012 SaaS vendors typically develop and manage their own software.

Whereas many initial ASPs offered more traditional client-server applications, which require the installation of software on users’ personal computers, later implementations can be Web applications that only require a web browser to use.

Whereas the software architecture used by most initial ASPs mandated maintaining a separate instance of the application for each business, as of 2012 SaaS services can utilize a multi-tenant architecture, in which the application serves multiple businesses and users, and partitions its data accordingly.[citation needed]

The acronym first appeared in the goods and services description of a USPTO trademark, filed on September 23, 1985.DbaaS (Database as a service) has emerged as a sub-variety of SaaS and is a type of cloud database.

Microsoft referred to SaaS as “software plus services” for a few years.

Vertical vs Horizontal SaaS

Horizontal SaaS and vertical SaaS are different models of cloud computing services.[24] Horizontal SaaS targets a broad variety of customers, generally without regard to their industry.

Some popular examples of horizontal SaaS vendors are Salesforce and HubSpot. Vertical SaaS, on the other hand, refers to a niche market targeting a narrower variety of customers to meet their specific requirements.[25]

TPaaS

Electronic bill payment is a feature of online, mobile and telephone banking, similar in its effect to a giro, allowing a customer of a financial institution to transfer money from their transaction or credit card account to a creditor or vendor such as a public utility, department store or an individual to be credited against a specific account.

These payments are typically executed electronically as a direct deposit through a national payment system, operated by the banks or in conjunction with the government. Payment is typically initiated by the payer but can also be set up as a direct debit.

In addition to the bill payment facility, most banks will also offer various features with their electronic bill payment systems.

These include the ability to schedule payments in advance to be made on a specified date (convenient for installments such as mortgage and support payments), to save the biller information for reuse at a future time and various options for searching the recent payment history.

In many cases the payment data can also be downloaded and posted directly into the customer’s accounting or personal finance software.

TPaaS -An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

Read More About Compliance Testing

Buy From Amazon